Vacant Home Tax Toronto: 7 Smart Insights You Need to Know

1. Understanding the Vacant Home Tax Toronto

Toronto’s skyline is not just a vista of soaring architecture; it’s a reflection of our homes, our lives, and our community. Yet, beneath this urban canopy, a silent challenge lurks – the crisis of vacant homes. It’s time to unfold the narrative of the ‘Vacant Home Tax Toronto’ – a strategic move by the city to transform idle spaces into bustling homes.

As you may have heard by now, the introduction of the Vacant Home Tax (VHT) by Toronto’s City Council aims to tackle the persistent housing crisis by converting empty houses into available homes. This initiative, which became effective in 2022, aims to boost the housing stock by deterring the practice of leaving properties unoccupied.

2. Defining a ‘Vacant Home’

A ‘vacant home’ in Toronto’s terms refers to a property not used as the principal residence by the owner, a tenant, or an authourized occupant for six months or more in the past year. Understanding this is crucial for homeowners to comply with the new regulations and avoid the VHT.

3. The Primary Aim of the VHT

The VHT seeks to motivate property owners to either occupy or rent out their residential spaces. This tax is calculated based on the property’s occupancy status from the previous year, and the revenues are channeled toward affordable housing programs. It’s a response to the severe rental market squeeze, the tightest since 2001.

4. The VHT Rate: A Closer Look

Toronto homeowners face a VHT rate of 1 percent of the Current Value Assessment (CVA) for properties vacant for over six months in the past year. This move is in line with similar actions being considered in other jurisdictions such as Hamilton and Peel.

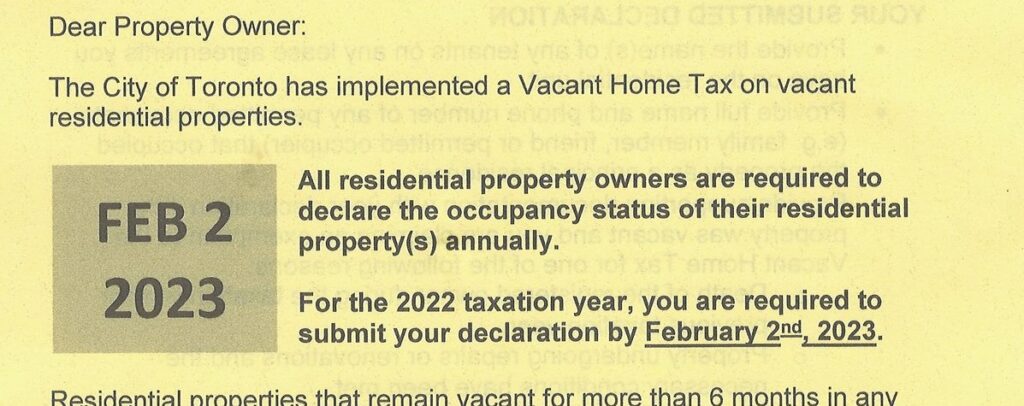

5. Mandatory Declaration Process Simplified

Toronto residential property owners are required to annually declare their property’s occupancy status. Nearly 95 percent of homeowners have complied using the City of Toronto’s online portal. Non-declaration incurs a fine, and non-payment leads to additional charges and possible legal consequences.

6. Exemptions to the Vacant Home Tax Toronto

Not all vacant homes are subject to the vacant home tax Toronto. Exemptions include cases such as the death of the owner, the principal resident being in care facilities, court orders, necessary renovations, and legal ownership transfers. Importantly, the tax doesn’t affect those with vacation homes or properties under rental.

7. Weighing the VHT: Pros and Cons

The VHT could potentially bring in millions annually for housing initiatives, as seen in Vancouver’s experience with its vacant home tax. It might also encourage the use of empty homes. However, there’s skepticism about its long-term effectiveness in addressing the affordability crisis without an increase in new home construction.

The Takeaway

The Vacant Home Tax in Toronto is more than just a government levy; it’s a strategic move aimed at transforming the housing landscape. In the short term, the tax incentivizes homeowners to either put their vacant properties to use or contribute to a fund that supports affordable housing projects.

This could potentially mean more homes for rent or purchase, relieving some of the pressure in the city’s tight housing market. However, the true measure of success will be in how sustainable these changes are over time. Will this tax be enough to alter the trend of property speculation? Can it encourage a more equitable distribution of housing? These are questions that only time will answer.

Meanwhile, for those involved in the housing market, understanding and adhering to the rules of the Vacant Home Tax is essential. Doing so not only prevents costly penalties but also aligns with a broader civic responsibility. Every existing homeowner, buyer or seller who chooses to participate actively or passively is contributing to a larger, more inclusive vision for Toronto’s future—where housing is accessible and affordable for all its residents.