Will Toronto Real Estate Crash?

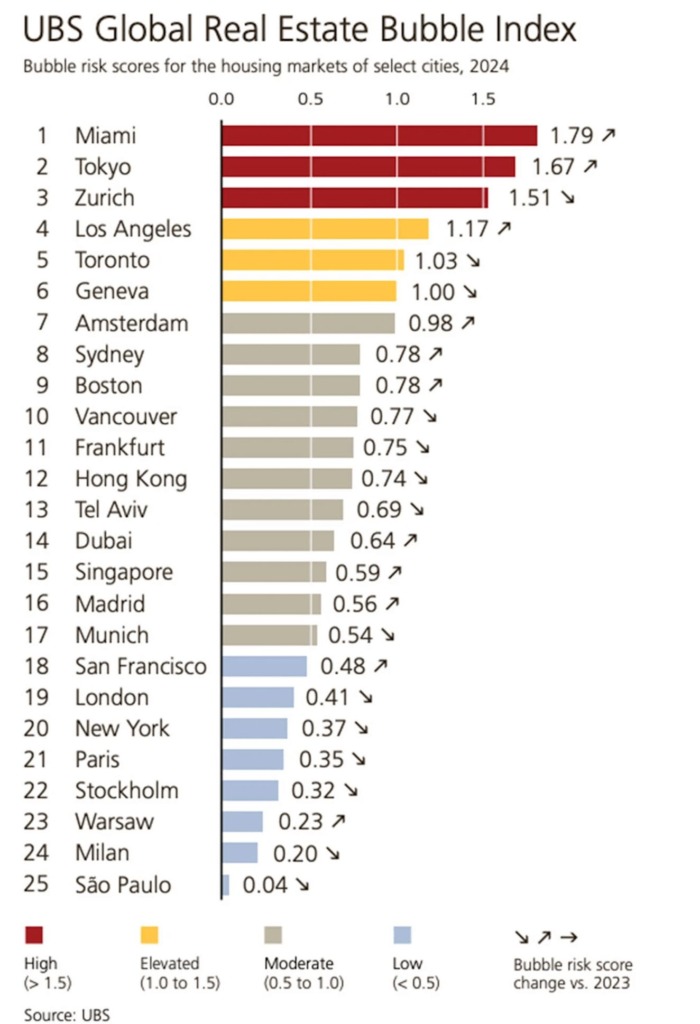

Toronto’s real estate market has been a hot topic of conversation for years. With its soaring prices, rapid growth, and increasing concerns about a potential housing bubble, it’s no wonder people are asking: Will Toronto real estate crash? Recent analyses, such as the UBS Global Real Estate Bubble Index, have shone a spotlight on the elevated risk associated with Toronto’s housing market. The city is often ranked among the most at-risk for a potential correction, but what does that mean for buyers, sellers, and investors?

Whether you’re a first-time homebuyer eager to enter the market or a current homeowner wondering about your property’s future value, understanding the factors at play is crucial. Let’s explore the recent trends, and expert opinions to help you make informed decisions about Toronto’s ever-evolving real estate market.

If you’re looking for personalized guidance on navigating the market, feel free to reach out—I’m here to help you make sense of it all and plan your next steps with confidence.

Understanding the Bubble Risk

The UBS index evaluates cities based on factors such as the price-to-income ratio, price-to-rent ratio, and the disparity between city and country price trends. Toronto’s high scores in these categories suggest that property prices are significantly detached from local incomes and rents, signaling a heightened risk of a market correction, leading some to ask, will Toronto real estate crash?

Recent Market Trends: Will Toronto Real Estate Crash?

In recent months, Toronto’s real estate market has shown signs of cooling. Reports indicate that home prices have declined by approximately 19 percent from their peak, approaching the technical definition of a market crash, typically characterized by a 20 percent drop from peak values.

Additionally, the number of housing units for sale has reached a 10-year high. This surge in inventory suggests that homeowners are eager to sell, possibly due to rising mortgage rates and economic uncertainties. A higher number of listings often shifts the market dynamic, giving buyers more options and potentially leading to downward pressure on prices.

Factors Influencing the Market

Toronto’s real estate market is shaped by several key factors:

- Interest Rates

The Bank of Canada’s monetary policies directly impact mortgage rates. Recent rate cuts aim to stimulate the economy, but their effect on the housing market remains uncertain. As rates fluctuate, so do buyer affordability and market demand. - Supply and Demand

A growing housing inventory coupled with cautious buyer sentiment can result in slower sales and lower prices. In Toronto, the recent spike in listings suggests a shift from a seller’s market to a buyer’s market. - Economic Conditions

Broader economic factors, such as employment rates and consumer confidence, heavily influence housing market trends. Economic slowdowns or uncertainties tend to dampen demand for housing, potentially leading to price corrections.

Expert Predictions

While some analysts forecast a continued decline in home prices, others believe the market will stabilize without experiencing a full-blown crash. For instance, Oxford Economics predicted a potential 24 percent drop in Canadian home prices by mid-2024, with the possibility of a more severe 40 percent decline if economic conditions worsen or corrective measures are not effective.

Will Toronto real estate crash? It’s important to note that market corrections are often gradual, giving buyers and sellers time to adapt. This measured decline contrasts with the sudden, catastrophic crashes seen in other markets.

What Does This Mean for Toronto Home Buyers and Sellers?

- For Buyers

A cooling market could present opportunities to purchase properties at more reasonable prices. However, it’s essential to assess your financial situation carefully. Pay close attention to mortgage rates and your long-term goals before making a decision. - For Sellers

If you’re looking to sell, you may face increased competition and might need to adjust your price expectations. Working with an experienced and knowledgeable real estate professional like me can help you strategically position your property in the current market.

Final Thoughts: Will Toronto Real Estate Crash?

The question of whether Toronto’s real estate market will crash doesn’t have a simple answer. While the data indicates the potential for a correction, this doesn’t necessarily mean a catastrophic collapse. Instead, the market is more likely to see gradual adjustments influenced by interest rates, economic conditions, and buyer sentiment.

Whether you’re considering buying, selling, or simply staying informed, having the right guidance can make all the difference. If you’re ready to navigate Toronto’s real estate market with confidence, let’s connect! I’d love to help you explore your options, answer your questions, and create a strategy that fits your unique needs. Reach out today, and let’s make your real estate goals a reality!